Publish date:

Salesforce is the top customer relationship management (CRM) platform and ranks fourth among employers on the Fortune 100 list. The company has around 80,000 employees and 150,000 users worldwide, and many large companies use It.

-

Spotify

-

Amazon Web Services

-

SplashLearn

-

Walmart

-

Toyota

-

BMW

-

Riveron

-

American Express

-

Appirio, and others.

This article highlights key statistics showing Salesforce's growth from last year to this year.

How Many Companies Use Salesforce?

Salesforce is a leading customer relationship management (CRM) platform. It has over 150,000 customers worldwide, including major companies like Walmart and Amazon Web Services. These companies have annual revenues of $611.3 billion and $80 billion, respectively. Salesforce employs over 80,000 people, making it one of the largest and most popular cloud software providers.

What Companies Use Salesforce?

Some of Salesforce's largest customers include well-known companies like AWS, Walmart, IBM, NASA, Unilever, Mercedes-Benz, and US Bank. They chose Salesforce CRM because it focuses on users, offers strong security, meets international standards, and allows them to create customized systems tailored to their needs.

Who uses Salesforce in the US?

Some of the biggest Salesforce customers in the USA are U.S. Bank, AWS, American Express, Walmart, and T-Mobile. By the end of 2022, more than 59% of Salesforce clients were from the USA.

In 2024, Salesforce has over 150,000 customers. The number of Salesforce users is expected to double by the end of 2026. In the United States, the list of companies using Salesforce includes the following:

-

Amazon Web Services (80 billion USD of Annual Revenue)

-

The New York Post (9.9 billion USD)

-

U.S. Bank (22 billion USD)

-

Walmart (611.3 billion USD)

-

Macy’s (24.4 billion USD)

-

T-Mobile (19.2 billion USD)

-

L’Oreal Americas (10 billion USD)

-

American Express (55 billion USD)

-

The Hershey Company (10.8 billion USD)

Among Salesforce's customers, 49% are small businesses with fewer than 50 employees, 40% are medium-sized businesses, and 11% are large businesses with over 1,000 employees.

Salesforce CRM is very popular among small businesses, especially those with annual revenues between 1 and 10 million USD. The next largest group is businesses with 10 to 50 million USD in revenues. The largest companies with revenues up to a billion come in third place.

_by_Revenue_copy.webp)

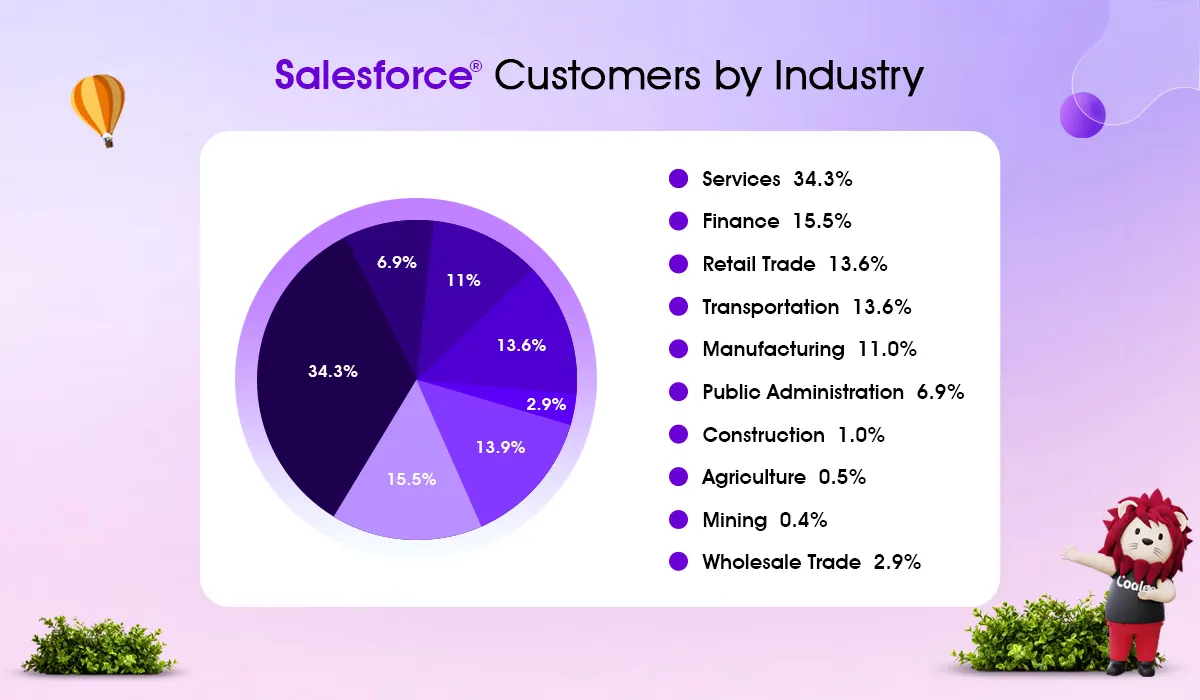

Salesforce Customers by Industry & Country

Salesforce CRM is used in many industries, including Commercial Real Estate, Private Equity, higher education, and Nonprofit organizations.

What industries use Salesforce most often? As of 2025, most companies that use Salesforce are in professional services (29%). This includes lawyers, advertising professionals, architects, and accountants. Other key sectors are manufacturing (11.1%), financial and banking services (9.8%), and retail (7.8%). Salesforce is less common in consumer packaged goods (5.4%) and media (4.4%).

The most well-known companies that use Salesforce in the sphere of professional services are:

-

Accenture

-

American Express

-

Bain & Company

-

Bank of America Corporation

-

Boston Consulting Group

-

Columbia Banking system

-

Deloitte

-

EY

-

KPMG

-

McKinsey & Company

-

PwC, etc.

BlueScope Steel, KONE, and Schneider Electric are in the manufacturing sphere.

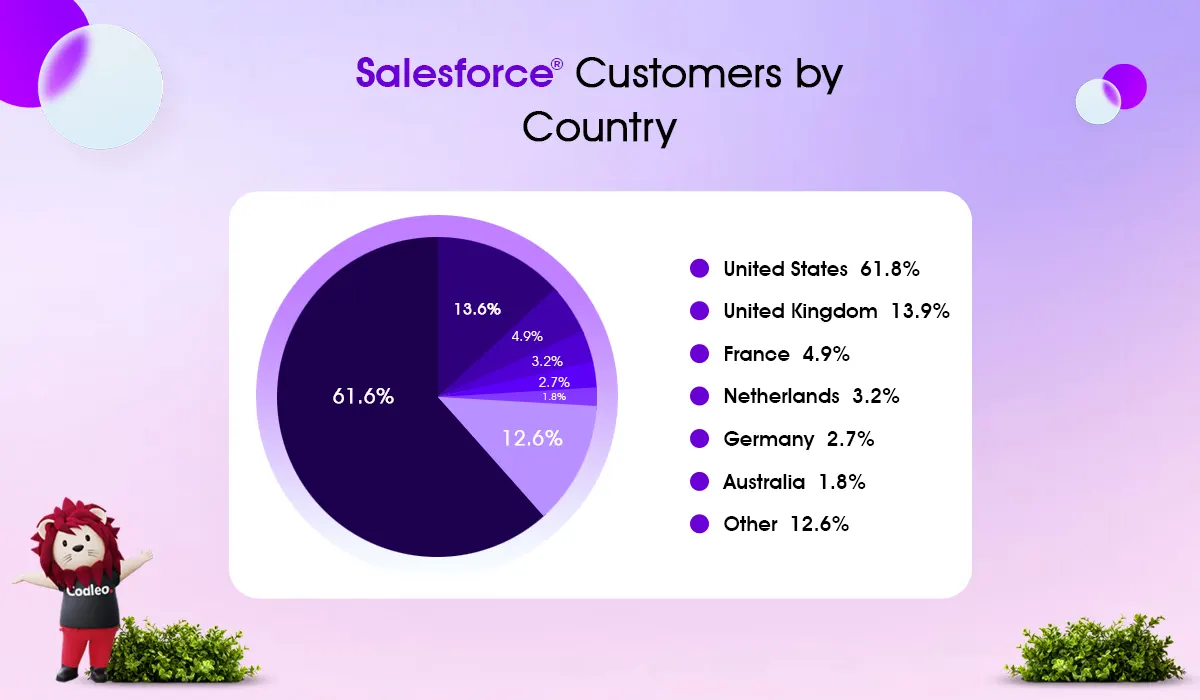

What countries use Salesforce the most?

About 61.8% of Salesforce customers are in the USA. The most significant numbers come from California, with 9,018 customers, followed by New York, with 3,913, and Texas, with 3,891. After the U.S., the next largest group of customers is in the U.K. at 13.6%, and then in France at 4.9%.

Why is Salesforce so popular?

About 61.8% of Salesforce customers are in the USA. Most of the users are in California, with 9,018 customers. Next is New York, with 3,913 customers, followed by Texas, with 3,891. After the U.S., the U.K. has the next largest group of Salesforce customers at 13.6%, and France follows with 4.9%.

-

Consumer Goods

-

Media

-

Retail

-

Energy & Utilities

-

Financial Services

-

Public Sector

-

Travel & Hospitality

-

Education

-

Healthcare & Life Sciences

-

Nonprofit

-

Manufacturing

-

Communications

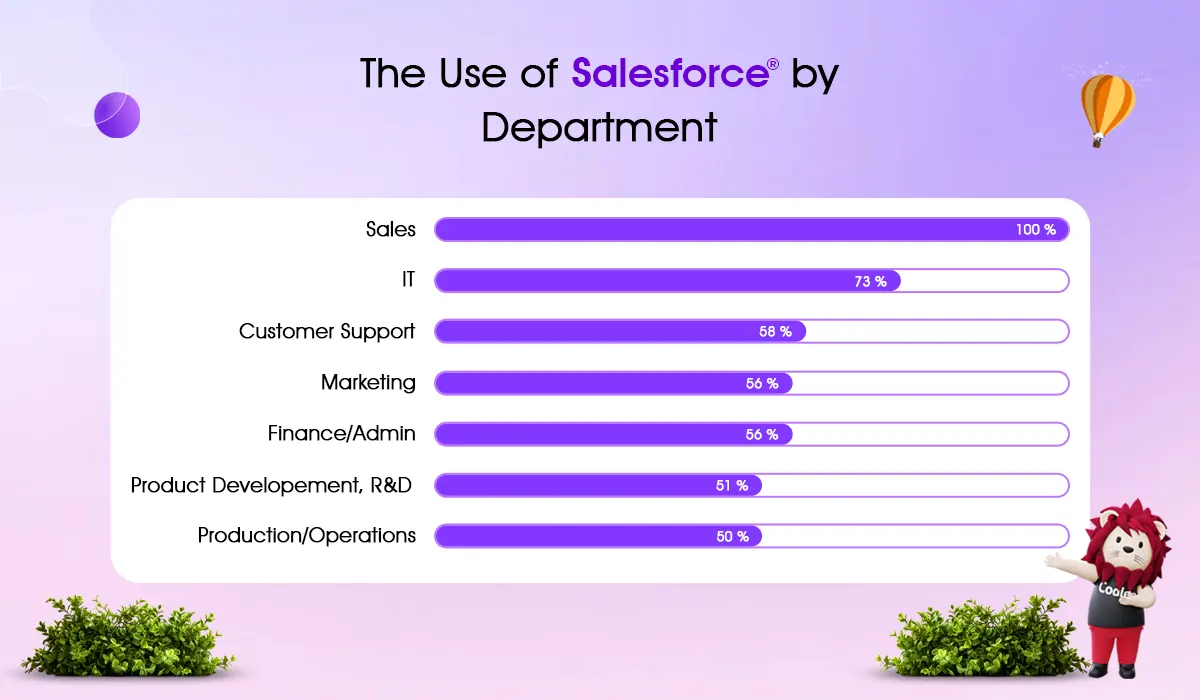

Many Salesforce customers use the platform to simplify their sales processes. IDC says this makes sales operations more efficient and helps generate more leads(Source). In addition to sales teams, customer support teams can benefit from using Salesforce CRM.

Who uses Salesforce in the company, if talking about departments?

Sales departments most commonly use Salesforce. Other departments that use it include IT, Customer Support, Marketing, and Finance/Administration. Product Development and Operations departments use Salesforce less often, as shown in the graph below. This challenges the belief that only sales teams benefit from Salesforce. In reality, Salesforce improves the entire business, helping every department.

The detailed distribution of Salesforce products for different departments is as follows:

Companies that use Salesforce want to achieve specific results from their new Salesforce solutions:

-

improved customer experience – 30%

-

operational improvements – 25%

-

higher employee productivity – 23%

-

faster research and development (R&D) and product development – 22%.

Many companies use Salesforce, and an impressive fact is that many see a return on their investment (ROI) in just one year. Some companies return 58% of their investment in less than a year. Some Salesforce users report an ROI as high as 500%. About 60% of customers who use the core Salesforce service want to buy additional services from Salesforce.

Percentage of Fortune 500 Companies that Use Salesforce

In 2022, 90% of Fortune 500 companies used Salesforce to manage their business relationships. This is up from 83% in 2017. Some top Fortune 500 companies that use Salesforce include Spotify, Amazon Web Services, Toyota, and Walmart Inc.

Below are some other Fortune 500 companies using Salesforce:

Walmart Inc. and Amazon are two of Salesforce's biggest customers. Walmart has revenues of $611 billion, and Amazon has revenues of $538 billion(Source).

Is Salesforce a Fortune 500 company?

Salesforce is on the Fortune 500 list, ranking #133 in 2023. The company moved up 54 spots from #190 in 2020, thanks to a 29.1% growth in revenue. Since it first appeared in 2015, Salesforce has moved up over 200 places. (Source).

Salesforce Market Share & Top Competitors

Salesforce is a top customer relationship management (CRM) provider. Founded in 1999, the company has grown rapidly. It now holds a large share of the market and outperforms its competitors. Salesforce offers more advanced digital solutions for businesses of all kinds.

Salesforce has been the top CRM in the world for nine years. It now provides services to some of the largest companies globally. This text will examine key questions about Salesforce’s role in the digital market.

What is Salesforce’s market share?

As of 2022, Salesforce holds a 23% share of the global software market, according to the latest report by IDC. The company competes with 163 other companies in providing CRM services.

Who are the top Salesforce competitors?

Salesforce's main competitors are Microsoft, Adobe, Oracle, and SAP. Together, these four companies hold only 18.7% of the market share. In comparison, Salesforce has a market share of 23.36%.

According to IDC, Salesforce products lead the market in customer relationship management (CRM) services, sales apps, customer care apps, and marketing apps(Source).

-

Salesforce's Marketing Cloud has a 14.1% market share, while its closest competitor, Adobe Experience Cloud, has a 12% market share.

-

Sales Cloud reached 40.6%, nearly four times higher than its main competitor, Microsoft Dynamics 365 Sales.

-

Service Cloud has a 45.3% market share, while Oracle has only 8.3%.

Salesforce Growth Over the Years

Salesforce has experienced strong growth over the years, expanding in size and revenue. In the last 20 years, Salesforce's revenue has grown at an average annual rate of 51.22%, and the average revenue growth over the past 10 years has been 29.04%. The diagram below illustrates the rapid increase in Salesforce's revenues over the last two decades.

Salesforce has grown steadily since it started, and its number of employees has increased consistently as the company expanded globally. As of 2023, Salesforce has about 79,390 employees, an 8% rise from 2022's total of 73,541. The detailed number of Salesforce employees is shown below:

Salesforce Revenue

General Revenue

What is Salesforce revenue? Salesforce made $31.35 billion in revenue in 2023. This is a significant increase from $26.5 billion in 2022 and $21.3 billion in 2021(Source).

Salesforce has a bright future. In 2024, their revenue is expected to hit a record $34.6 billion. This will grow even more, reaching $50 billion by 2026. They currently have an annual growth rate of 18%. To put it in perspective, Salesforce’s revenue in 2022 is ten times what it was ten years ago.

Salesforce Services Revenue

Recently, the company has seen a 14% rise in revenue from subscriptions and support services and a 19% increase in revenue from professional services(Source). Subscription and support services comprise over 93% of Salesforce’s total revenue, about 29 billion USD in 2023. Although professional services only account for around 7% of the company's revenue, slightly more than 2 billion USD for 2023, we expect their share of total revenue to grow by the end of this year.

Salesforce's annual revenue comes mainly from Salesforce AppExchange and subscriptions, which comprise 93.1% of its total revenue. Only 6.9% of its revenue comes from professional services and other activities.

Salesforce Products Revenue

Salesforce offers four main products, each focused on a specific part of business operations. The products are:

-

Sales Cloud

-

Service Cloud

-

Platform (and Other)

-

Marketing and Commerce

Salesforce's largest revenue source is “Service Cloud,” which earned almost $7 billion in 2023. In the past, the main revenue came from Sales Cloud, which made just over $5 billion this year. This amount is the third highest among the company's products and is more than Sales Cloud earned last year.

Salesforce Platform, Tableau, and MuleSoft earned about 6 billion dollars in revenue, 40% more than last year. This makes them the second-highest revenue-generating segment. The marketing and commerce cloud, which offers marketing automation and commerce campaigns, generated 3.13 billion dollars, placing it last.

Salesforce is more than just four cloud services. It represents a whole ecosystem of related products, additional cloud subscriptions, and IT solutions offered by CRM consulting companies and software developers. These partners help Salesforce customers with CRM implementation and integration(Source). According to Salesforce, 86% of customers use partner apps and solutions, highlighting the importance of this ecosystem.

Codleo is a leading Salesforce partner that provides consulting and software development services. They have over 10 years of experience in the CRM industry.

IDC estimates that the global Salesforce ecosystem is five times larger than Salesforce. This means that for every dollar Salesforce made in 2021, the ecosystem made $4.96. This number is expected to grow to $6.19 by 2026.

Salesforce Revenue by Country

Salesforce's largest market is the Americas, which generates about 20 billion USD in revenue. North and South America customers generate an annual revenue growth of 22.3%.

Europe ranks second in revenue, generating 4.5 billion USD each year. However, this could change soon. Income from European customers has already risen by 31%, surpassing the growth rates of the global company and those in the Americas and the Pacific regions.

The Asia Pacific region is currently the smallest market for Salesforce's profits. It generates about 2 billion USD in annual revenue and has a growth rate of 24%. The Asian market will likely remain in third place for the foreseeable future.

Salesforce and its cloud products are expected to generate up to $1.6 trillion in revenue worldwide. This amount includes the economic value that Salesforce customers will add to their local economies using the company’s services. The United States will see significant revenues of over $531 billion, making it the leader. Japan follows with $97.4 billion, Germany with $94.4 billion, and the UK with $71.6 billion.

Overall, Salesforce is actively used worldwide, and regardless of the territory, it contributes positively to other businesses' growth and development by unifying processes and easing operations.

Salesforce Subsidiaries & Acquisitions

Salesforce has grown quickly due to many company acquisitions and subsidiaries. These acquisitions have helped strengthen Salesforce’s position in the technology industry and improve its ability to provide complete solutions to its customers.

Here, we explore Salesforce’s approach to acquiring companies and managing its subsidiaries by answering common questions about the company.

Who did Salesforce acquire recently?

Salesforce's latest major acquisition is Slack, a workplace messaging service that helps businesses communicate internally and offers additional services and integrations. Salesforce announced the deal in December 2020 and finalized it in July 2021(Source). This acquisition is notable for being the largest in software history, costing 27.7 billion USD.

Salesforce bought Slack to integrate its popular messaging and collaboration tools into its CRM system. This move responds to the growing need for remote work and easy team communication. The acquisition is a key step in Salesforce's becoming a complete digital workplace platform.

The deal was one of Salesforce’s best investments. It boosted Salesforce’s revenue by nearly $600 million in the last half of fiscal year 2022 and is expected to add another $1.5 billion to its revenue for fiscal year 2023(Source). Like other companies it has acquired, Salesforce now offers Slack on its AppExchange marketplace, making it a valuable part of its ecosystem.

In 2022, Salesforce focused on buying companies to enhance its existing ecosystem and support its infrastructure. The company made three major acquisitions: Track on Demand, a consultancy firm; Phennecs, a compliance services vendor; and Troops.ai, a sales automation bots provider.

How many acquisitions has Salesforce made?

Since its inception, Salesforce has bought 70 companies, including Tableau, MuleSoft, Demandware, ExactTarget, Vlocity, and Slack. In 2020, these purchases cost $29.1 billion. The most acquisitions happened in 2016 when Salesforce acquired 12 companies. The most significant purchases were Slack for $27.7 billion, Tableau for $15.7 billion, and MuleSoft for $6.5 billion. Overall, Salesforce has spent over $70 billion on its acquisitions.

What subsidiaries does Salesforce have?

It can be hard to tell which companies belong to Salesforce since they often offer services under different names. Quip, Heroku, MuleSoft, Tableau, SoftwareAcumen Solutions, and Slack Technologies are commonly recognized as Salesforce subsidiaries. Some sources include Datorama, Inc., ClickSoftware Technologies, Demandware, Inc., BeyondCore, and Clipboard as Salesforce subsidiaries. Below is the complete list of Salesforce subsidiaries:

Here you can find more information about Salesforce Subsidiaries and their market projected growth:

-

Mulesoft is a leader in the software integration market, which is expected to grow at 15.4% from 2021 to 2028. Due to its strong position in the industry, Mulesoft will likely see its revenue grow even faster than the overall market in the coming years.

-

Datorama specializes in marketing, advertising, and data management software. According to Mordor Intelligence, this market is expected to grow by 19.4% annually from 2021 to 2028. Datorama is an essential company in this field, and its revenue will likely increase significantly.

-

Clipboard. Grand View Research predicts that the short-term data storage and transfer software market will grow by 12.1% annually from 2021 to 2028. Clipboard is a new player in this market, but it has already gained a significant share and is showing strong results.

-

Coolan. MarketsandMarkets predicts that the data analytics platform market will grow at 17.9% annually from 2021 to 2028. Coolan is a major player in this market.

-

Heroku provides a Platform as a Service for industrial IoT. According to Fortune Business Insights, this market is expected to grow at 14.8% each year from 2021 to 2028.

-

Quip. Quip is a leading provider of tools that help businesses work better together. Its software allows users to easily edit shared documents, manage accounts, and take notes. According to Mordor Intelligence, Quip’s productivity software market is expected to grow by 10.2% annually from 2021 to 2028.

-

ClickSoftware Technologies. ClickSoftware Technologies is a leader in workforce and service management software. According to MarketsandMarkets, this industry is expected to grow 11.8% annually from 2021 to 2028.

-

Tableau is a well-known provider of data analytics software. According to MarketsandMarkets, the financial services and analytics software market is expected to grow 17.2% annually from 2021 to 2028.

-

Slack is a significant platform for business communication and collaboration alongside Microsoft and Google tools. Markets and Markets predicts that the team communication software market will grow 14.6% annually from 2021 to 2028, which means Slack will likely increase its revenue even more.

How Many Employees Work for Salesforce?

Salesforce had 79,390 employees worldwide in the 2023 fiscal year, nearly a 60% increase since 2020. Most employees (58%) work in the US, while 42% are in 84 international Salesforce offices worldwide.

Salesforce increased its employees by nearly 8% in 2023 compared to 2022. This growth came despite a hiring freeze from November 2022 to January 2023. In January 2023, the company announced plans to cut its workforce by 10%, which is about 8,000 employees(Source).

Salesforce has grown massively over the past 20 years. In 2005, the company had only 767 employees. Fast forward to 2023, and that number is nearly 80,000. That’s pretty impressive.

The number of Salesforce employees doesn’t give a complete picture of its culture and values. Salesforce focuses on being welcoming and inclusive. It supports minorities, LGBTQ employees, and people of all genders, ages, and abilities. 50.7% of Salesforce employees come from underrepresented groups(Source).

Salesforce has been ranked on the FORTUNE 100 Best Companies to Work For list for 14 years. In 2023, it scored #8 on the list.

Salesforce and its partner ecosystem play a significant role in the global job market. By the end of 2026, Salesforce is expected to create 9.3 million jobs worldwide and generate $1.6 trillion in new business revenue globally.

Salesforce and its partners have created 3.8 million direct jobs through their solutions. Additionally, these direct employees and their spending have generated 5.5 million indirect job opportunities in the local economy.

Salesforce is a group of successful products, a growing network of partners, and related products that help the global economy.

Salesforce as an AI Pioneer

Salesforce is a leading company in the CRM market. It helps both large businesses and startups use their data to increase productivity, improve customer satisfaction, and grow their annual revenues. Because of this, Salesforce was the first company to embrace AI development in real estate, especially in generative AI, during the rise of AI and GPT technology.

What is generative AI, and why is Salesforce so passionate about it?

A generative AI model offers new possibilities for Salesforce users by creating images, text, videos, and sounds to build a virtual world. This AI continually learns and improves itself based on the data it receives.

In March 2023, Salesforce launched Einstein GPT. This generative AI tool is designed specifically for customer relationship management (CRM) and is part of the Customer 360 platform. It works with OpenAI, especially ChatGPT technology, and connects with all Salesforce clouds, Tableau, Slack, and MuleSoft. Einstein GPT helps create content like personalized emails for marketing and sales teams and responses for customer care teams. It also automates code generation for developers.

Recently, the company has significantly advanced its AI development. In June 2023, Salesforce launched an AI Cloud built on Einstein GPT. This cloud provides AI features across all of Salesforce's services. It helps manage tasks, analyze customer behavior, and handle sales and marketing. This aims to increase revenue and enhance Salesforce clients' presence in the real estate market.

Salesforce understands the security risks that AI can create. The company has developed the AI cloud using the Einstein GPT Trust Layer to protect customer data. This allows users to train AI models on their data without worrying about it being hacked.

AI Cloud is built on Einstein GPT and combines multiple systems in one place.

-

Sales GPT—This system includes automatic email generation and meeting scheduling. It also has a Sales AI feature. Built as an extension of Sales Cloud, Sales AI helps users improve their sales results by automating and personalizing sales tasks using Einstein GPT.

-

Service GPT—Service GPT is a new feature in the Service Cloud that automatically creates personalized responses in customer service chats.

-

Marketing GPT – Creating personalized web content and advertising.

-

Slack GPT—Collaboration tools are getting better with AI. Slack GPT helps users by summarizing conversations, providing AI-driven research, and automatically creating message drafts.

-

Einstein GPT for Developers: Development teams can use the AI chat assistant to generate code efficiently or to ask questions about Salesforce's large language models.

We don't know how many companies use Salesforce AI, but some include Gucci, Inspirato, and RBC US Wealth Management. These big companies show that more Salesforce clients will likely use AI soon.

How Salesforce Supports AI Start-Ups

Salesforce Ventures is increasing its Generative AI Fund from $250 million to $500 million. This fund aims to support promising AI startups focused on generative AI. As a venture capital firm and a software developer in the CRM market, Salesforce has already invested in companies like Anthropic, Cohere, You.com, and Hearth. Salesforce will host their large language models on its infrastructure.

Salesforce Statistics

The data shows that Salesforce has grown significantly over the last ten years. Let's add some important facts and milestones that contributed to its success. In addition to various products, services, and clouds, Salesforce launched AppExchange, a platform where fans can share ideas.

Salesforce AppExchange is the top marketplace for cloud applications designed for businesses. Salesforce runs this platform. It allows third-party developers to create and share applications that work well with Salesforce products.

Apps, or applications, are designed to make Salesforce's CRM and cloud services more useful across different industries. Businesses can easily add these apps to Salesforce.org, improving and personalizing their CRM experience. Many customers use AppExchange to customize their CRM to fit their needs.

The service requires a subscription fee paid by third-party app providers. This system benefits both Salesforce and developers and contributes significantly to Salesforce's overall income. Salesforce does not share specific AppExchange revenue numbers; IDC estimates it generated $20 billion in 2020 for its 2,000+ independent software vendor (ISV) partners. In 2022, Salesforce announced that AppExchange installs surpassed 10 million, so we can only estimate how much revenue this generated for the company.

Salesforce is one of the most sustainable global companies. Since 2013, it has worked to help the world shift to clean and renewable sources of electricity.

Salesforce reached its goal in 2021 by using 100% renewable energy and achieving net-zero emissions across its entire value chain. Additionally, 7.39% of Salesforce customers said the company's cloud solutions helped them with their sustainability efforts.

Why Codleo as Your Salesforce Consulting Partner

You will face several challenges if you move to Salesforce as your central CRM platform. You'll need to decide which Salesforce Cloud to use and how to adjust the existing Salesforce features to fit your business needs. This way, you can make the most of your new investment.

Salesforce consulting partners help new customers succeed with Salesforce. They provide valuable advice for developing apps on the AppExchange, customizing CRM to fit needs, and setting up Salesforce solutions.

Codleo Consulting is a Salesforce Summit [Platinum] Consulting Partner, and a software development firm focused on the technical side of Salesforce and other top CRM platforms. For over 10 years, we have been helping the world’s leading companies with their CRM needs. Visit our case studies for more details.

Besides that, Codleo offers:

-

CRM products and apps

-

200+ professionals on board

-

Salesforce Certified Developers, App Builders, and Admins

-

Onshore and Offshore engagement models for cost compression

-

Top CRM consulting & custom software development company on Clutch.co.

Contact us if you have a Salesforce project but aren't sure how to start. Let us know your business challenges, or explore our Salesforce Quick Start packages for ready-made support.